It's certainly no secret that people have turned towards various forms of entertainment over the last year to stave off the anxieties of the pandemic. Consumers have been making the most of the internet in lockdown to play games and stream movies and music, and companies have been happy to oblige while gathering data to figure out exactly what people want and how best to monetize it. The answers to those questions may prove surprising, though, according to a new digital media trends report.

The survey, conducted by accounting and consulting firm Deloitte, polled 2,009 consumers from various different age groups ranging from teenage Gen Z-ers to the over-75s. The aim was to pin down the media consumption habits of different demographics and try to get an idea for how things might look in the near future, and the insights paint an intriguing picture for the future of streaming media.

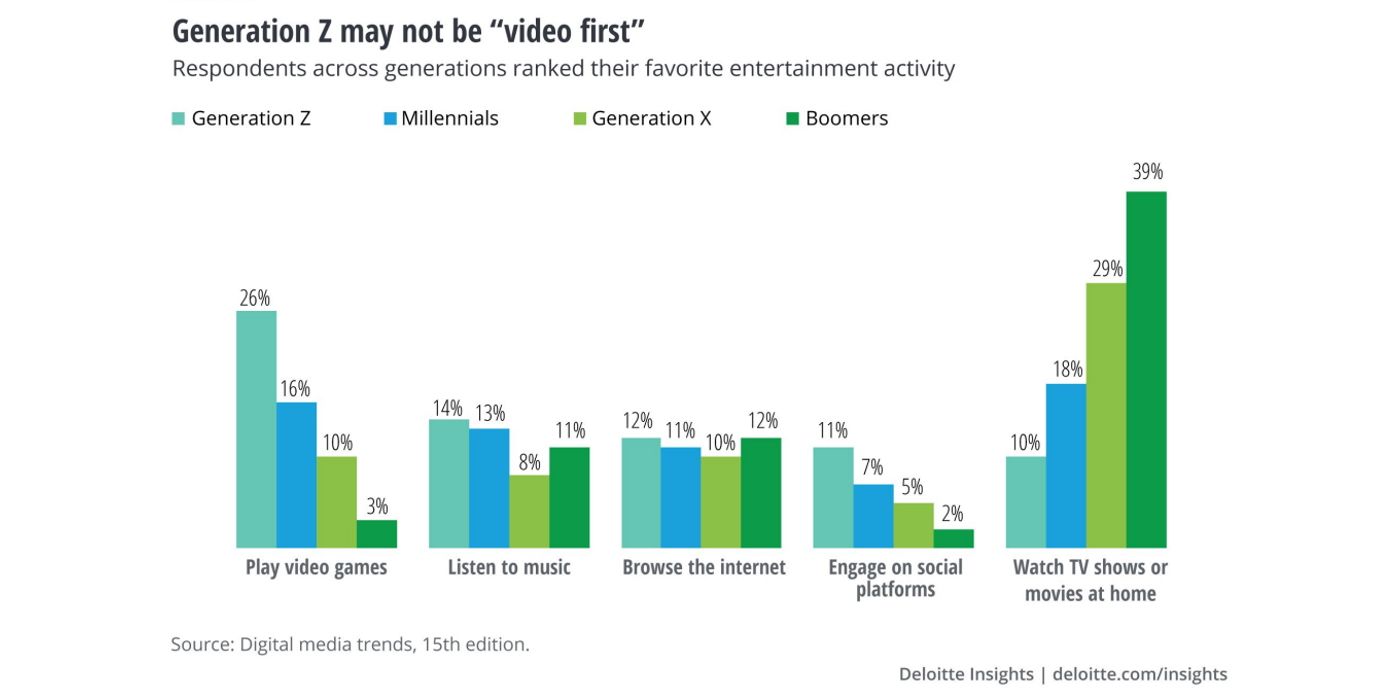

While "watching TV and movies at home" still proved the most popular entertainment activity overall with 57% of respondents putting it in their top three options, Generation Z looks to have the potential to buck that trend before long. 26% of Gen Z-ers put "playing video games" as their top option, and "TV and movies" ended up dead last behind "listening to music," "browsing the internet," and "engaging on social platforms." This could spell trouble for big video streaming services like Netflix and Disney+ in the long term, as the younger generations start procuring more buying power.

Even if it wasn't everybody's top choice, video games are clearly shown in the report to be a huge part of people's lives. A whopping 87% of Gen Z respondents, along with 83% of millennials and 79% of Gen X, report playing video games in some form at least weekly, with many playing daily for escapism, to connect with friends, or simply to pass the time.

On top of that, 45% of all respondents reported subscribing to at least one paid gaming service like Xbox Game Pass, with gamers allegedly having, on average, three active gaming subscription services. The survey also showed that, across all entertainment services, the biggest factor for cancelling a subscription was an increase in the monthly price, something that Microsoft discovered earlier this year when its announcement of a price hike for Xbox Live resulted in massive backlash and a swift U-turn.

There's plenty more to dig into in the report, from statistics for customer churn across services to info about where the respondents got their news, but the insight into the entertainment habits of younger consumers is perhaps the most interesting and potentially the most impactful on future business practices for the industry. It will be revealing to see how providers choose to use this information: whether they try to court Gen Z as they age into a key spending demographic or try to ignore the writing on the wall, the next few years may well see these huge companies doing a bit of soul-searching.

Source: Deloitte Insights