When the COVID-19 pandemic began in March 2020, federal and state governments in the US made funds available to help small businesses survive the loss of income due to lockdowns. Although a number of companies were negatively impacted by the coronavirus pandemic and shut down despite the assistance, this funding proved pivotal in helping many small businesses stay afloat, and most of the loans were interest free or qualified for forgiveness if certain requirements were met.

Some people took advantage of the small business pandemic assistance to line their pockets even though they didn’t legally qualify for the loans, or they used the funds for other than their intended purpose. Throughout 2020, there were many stories of large companies who didn’t need assistance finding loopholes to get loans, such as marking each branch of a chain of stores as a separate small business. One man, Vinath Oudomsine of Georgia, used fraudulently obtained COVID relief funds to purchase a Pokemon card for $57,789.

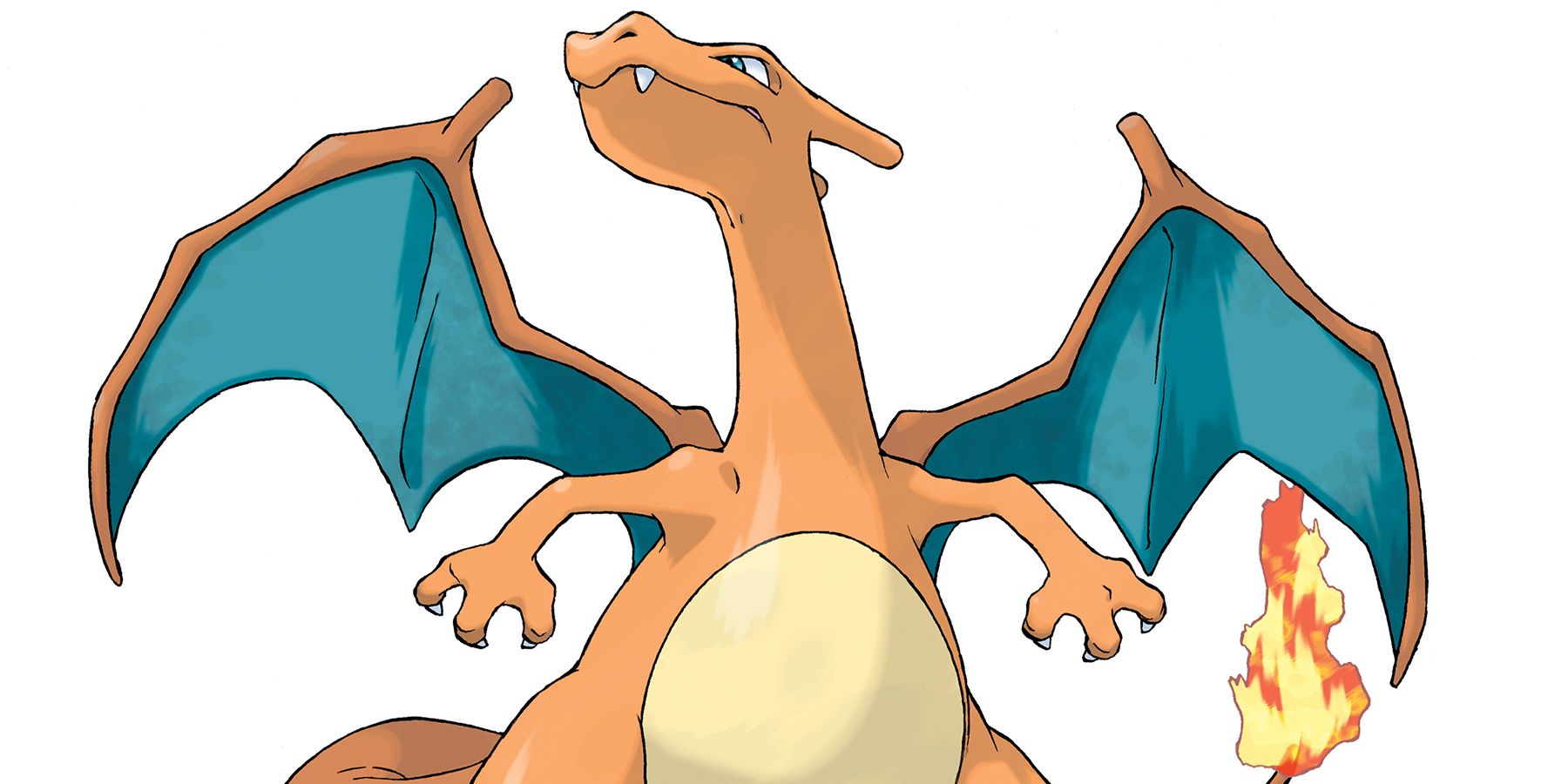

In July 2020, Oudomsine applied for an Economic Injury Disaster Loan through the US Small Business Administration, stating that the funds would be used to help his “entertainment services” business that he claimed had 10 employees and earned $235,000 in the previous 12 months. The Georgia man received $85,000 in August, which he then used to buy a rare Charizard card. Oudomsine’s fraudulent application was discovered, and he has subsequently been sentenced to three years in federal prison, followed by three years of "supervised release." He will also have to return the $85,000 loan money, pay a $10,000 fine, and forfeit the Pokemon card.

The specific Pokemon card purchased by Oudomsine has not been revealed by authorities, but Polygon discovered that in December 2020, a Charizard card with a 9.5 gem mint rating was sold on the PWCC Marketplace for the exact price Oudomsine paid for his card.

When speaking about the case, US Attorney for the Southern District of Georgia David H. Estes stated, “Like moths to the flame, fraudsters like Oudomsine took advantage of these programs to line their own pockets… We are holding him and others accountable for their greed.” The funds available through programs like the Economic Injury Disaster Loan were limited and quickly ran out due in part to fraudulent applications, leaving many small businesses without the assistance they legitimately needed. A number of these companies no longer exist today because they were unable to cover rent, utilities, payroll, and other expenses during lockdown.

The small business shutdowns have impacted many people’s everyday lives, and some iconic companies are now perhaps gone for good. In December 2021, the real-life Seattle game arcade where Ellie fights in The Last of Us 2 closed its doors. The owners of GameWorks shared on Twitter that the previous 20 months had turned the business “upside down,” and the slow economic recovery had not helped. GameWorks was a chain establishment with multiple locations, and they have all shut down as a result of the COVID-19 pandemic.

Sources: US Department of Justice, Polygon